Essay

The Bristol-Fuller partnership was formed on January 1, Year 1, when Bristol and Fuller invested $40,000 and $30,000 cash in the partnership, respectively. During Year 1, the partnership earned $75,000 in cash revenues and paid $52,000 in cash expenses. Bristol withdrew $5,000 cash from the business during the year, and Fuller withdrew $4,000. The partnership agreement specified that net income should be allocated equally to the partners' capital accounts.Required:

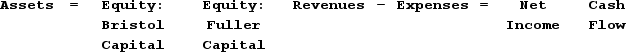

Indicate how each of the transactions and events for the Bristol partnership affects the financial statements model, below. Indicate dollar amounts of increases and decreases. For cash flows, indicate whether each is an operating activity (OA), investing activity (IA), or financing activity (FA). Indicate NA if an element is not affected by a transaction.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Which of the following is a disadvantage

Q28: For Year 1, the Sacramento Corporation had

Q29: On July 1, Year 1, Village Bookstore,

Q30: Which of the following describes the type

Q35: A reason often given for a corporate

Q36: Chandler Company declared and paid a cash

Q37: Which of the following is a reason

Q38: The Public Company Accounting Oversight Board (PCAOB)

Q57: Chisolm Corporation issued 10,000 shares of $5

Q60: Powell Corporation had $10 par stock with