Essay

The following information is for Poole Company for the current year:

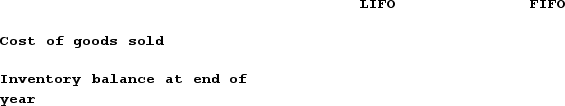

Required:Assuming that Poole uses the LIFO cost flow method, determine how much product cost would be allocated to Cost of Goods Sold, and how much to Merchandise Inventory at the end of the year. Show all calculations.Assuming that Poole uses the FIFO cost flow method, determine how much product cost would be allocated to Cost of Goods sold, and how much to Merchandise Inventory at the end of the year. Show all calculations.Compare your results from parts a and b. Do LIFO and FIFO give the same results for inventory turnover? Which is higher, and why?

Correct Answer:

Verified

a. and b.

c.

LIFO and FIFO do not giv...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

c.

LIFO and FIFO do not giv...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q17: After the accounts are adjusted at the

Q39: Indicate how each event affects the horizontal

Q40: Indicate how each event affects the horizontal

Q41: In the first year of operations, John's

Q44: Sierra Company uses the weighted average inventory

Q45: On January 1, Year 2, Burton Company

Q46: If Bowman Company is using FIFO,how would

Q47: The following information is for Choi Company

Q48: Indicate how each event affects the horizontal

Q49: Indicate how each event affects the horizontal