Essay

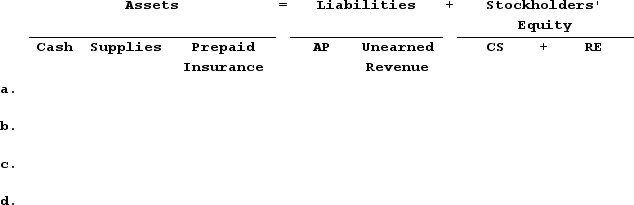

Using the form below, record each of the following transactions for Mayer Corporation during the year ending December 31, Year 1. (Note: There is no need to provide appropriate account titles for the Retained Earnings amounts in the last column of the table.)November 1: Received cash from clients for services to be performed over the next six months, $12,000November 1: Paid $1,200 for a 12-month insurance policyDecember 31: Recorded expiration of two months of the insuranceDecember 31: Earned $4,000 of the amount received from clients in November

Correct Answer:

Verified

Two months (Novembe...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Two months (Novembe...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q52: What does the balance in accounts receivable

Q68: Nelson Company experienced the following transactions during

Q68: Accounts that are closed include expenses,dividends,and unearned

Q69: Indicate for each of the following items

Q70: Nelson Company experienced the following transactions during

Q71: Stanley Company earns $8,000 of revenue

Q75: What is the primary goal of the

Q76: Pierce Company was founded in Year 1

Q77: Which of the following show how purchasing

Q78: Paying cash to settle a salaries payable