Essay

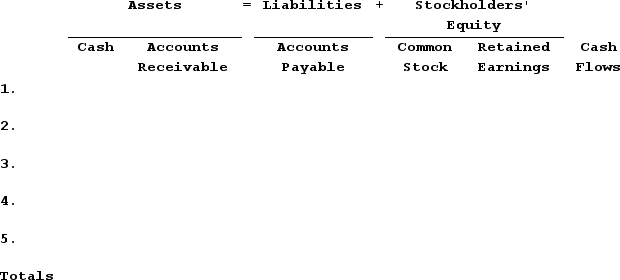

Cascade Corporation began business operations and experienced the following transactions during Year 1:Issued common stock for $20,000 cashProvided services to customers for $80,000 on accountIncurred $36,000 of operating expenses on accountCollected $46,000 cash from customersPaid $30,000 on accounts payableRequired:Record the above transactions on a horizontal statements model to reflect their effect on Cascade's financial statements. Classify each of the following transactions for the purpose of the statement of cash flow as operating activities (OA), investing activities (IA), or financing activities (FA). If a transaction is not reported on the statement of cash flows, leave that cell blank.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: The following transactions apply to Kellogg Company.Issued

Q29: Which of the following shows how

Q32: Jason Company paid $7,200 for one year's

Q34: The following pre-closing accounts and balances

Q35: ABC Company ended Year 1 with the

Q37: ABC Company ended Year 1 with the

Q38: After closing the accounts, all income statement

Q76: Recognition of revenue may be accompanied by

Q103: The matching concept most significantly influences which

Q133: In the closing process,the amounts in temporary