Not Answered

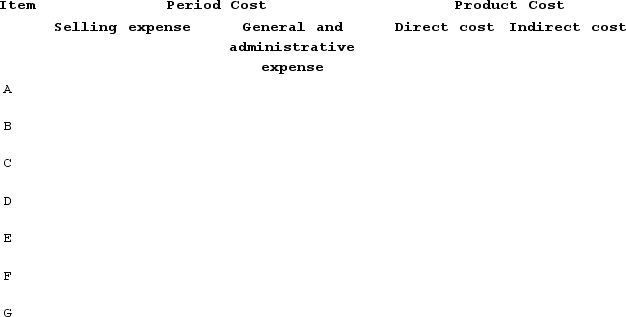

Classify each of the following costs for Harrison Company as a selling or general and administrative period cost or as a direct or indirect product cost by entering the dollar amount(s) in the appropriate column(s):Paid $75,000 in wages for employees who assemble the company's products.Paid sales commissions of $58,000.Paid $38,000 in salaries for factory supervisors.Paid $88,000 in salaries for executives (president and vice presidents).Recorded depreciation cost of $25,000. $13,000 was depreciation on factory equipment and $12,000 was depreciation on the company headquarters building.Paid $4,000 for various supplies that it used in the factory (oil and materials used in machine maintenance).Used $10,000 in prepaid corporate liability insurance.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: During its first year of operations, a

Q29: During its first year of operations, Connor

Q34: The following information relates to Marshall

Q35: The Giga Company produces tablet computers.

Q36: Complete the following table to compare and

Q80: The philosophy of encouraging workers to achieve

Q91: Does the term "cost" mean the same

Q111: Senior executives focus on financial data when

Q117: Tucker Company's work in process account decreased

Q144: What inventory holding costs would be incurred