Short Answer

TABLE 5-7

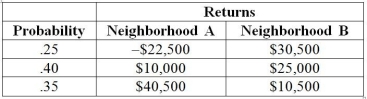

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition. The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Table 5-7, if your investment preference is to maximize your expected return while exposing yourself to the minimal amount of risk, will you choose a portfolio that will consist of 10%, 30%, 50%, 70%, or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Correct Answer:

Verified

Correct Answer:

Verified

Q81: TABLE 5-1<br>The probability that a particular type

Q82: TABLE 5-8<br>Two different designs on a new

Q83: TABLE 5-10<br>An accounting firm in a college

Q85: TABLE 5-8<br>Two different designs on a new

Q87: TABLE 5-3<br>The following table contains the probability

Q88: TABLE 5-8<br>Two different designs on a new

Q89: TABLE 5-8<br>Two different designs on a new

Q90: TABLE 5-8<br>Two different designs on a new

Q91: TABLE 5-8<br>Two different designs on a new

Q174: The probability that a particular brand of