Essay

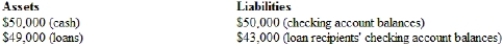

Use the information in this T-account to calculate this bank's reserve ratio. Assume that the reserve requirement is 25%. Is this bank meeting this reserve requirement? Calculate the new reserve ratio if the loan recipients convert their checking account balances to cash and take the cash out of this bank. Is the bank still meeting its reserve requirement?

Correct Answer:

Verified

The reserve ratio = reserves/checking ac...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q138: In 2007, the Fed reduced the stigma

Q139: The discount rate is the interest rate<br>A)

Q140: If the reserve requirement is 25%, a

Q141: A bank has excess reserves of $4,000

Q142: The Federal Reserve rarely uses control of

Q144: Monetary policy lags can last up to

Q145: When the Federal Reserve buys bonds, it

Q146: A lower reserve requirement<br>A) increases the ability

Q147: About _ of U.S. currency is held

Q148: The Fed works independently of political parties.