Multiple Choice

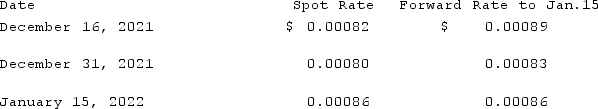

Jackson Corp. (a U.S.-based company) sold parts to a Korean customer on December 16, 2021, with payment of 20 million Korean won to be received on January 15, 2022. The following exchange rates applied:  Assuming a forward contract was not entered into, what would be the net impact on Jackson Corp.'s 2021 income statement related to this transaction?

Assuming a forward contract was not entered into, what would be the net impact on Jackson Corp.'s 2021 income statement related to this transaction?

A) $600 (gain) .

B) $600 (loss) .

C) $400 (gain) .

D) $400 (loss) .

E) $0

Correct Answer:

Verified

Correct Answer:

Verified

Q10: When a U.S. company purchases parts from

Q23: On March 1, 2021, Mattie Company received

Q25: Clark Co., a U.S. corporation, sold inventory

Q26: A U.S. company sells merchandise to a

Q30: Which is a true statement regarding the

Q34: A forward contract may be used for

Q66: Which statement is true regarding a foreign

Q78: Curtis purchased inventory on December 1, 2020.

Q83: For each of the following situations, select

Q85: All of the following data points are