Multiple Choice

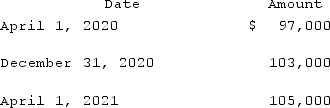

On April 1, 2020, Shannon Company, a U.S. company, borrowed 100,000 euros from a foreign bank by signing an interest-bearing note due April 1, 2021. The dollar value of the loan was as follows:  How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

How much foreign exchange gain or loss should be included in Shannon's 2020 income statement?

A) $3,000 gain.

B) $3,000 loss.

C) $6,000 gain.

D) $6,000 loss.

E) $7,000 gain.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Authoritative literature provides guidance for hedges of

Q11: Larson Company, a U.S. company, has an

Q14: Which of the following approaches is used

Q23: What happens when a U.S. company purchases

Q61: Williams, Inc., a U.S. company, has a

Q77: To account for a forward contract cash

Q84: On October 1, 2021, Eagle Company forecasts

Q89: On October 1, 2021, Jarvis Co. sold

Q91: Potter Corp. (a U.S. company in Colorado)had

Q92: On December 1, 2021, Keenan Company, a