Essay

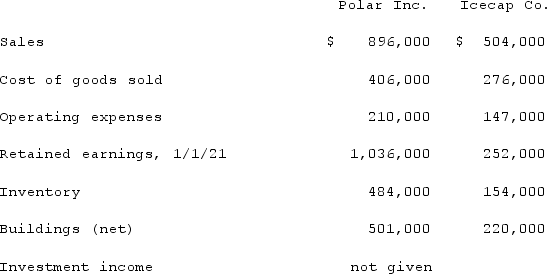

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Malone Co. owned 70% of Bernard Corp.'s

Q49: Stiller Company, an 80% owned subsidiary of

Q57: Pepe, Incorporated acquired 60% of Devin Company

Q62: Stark Company, a 90% owned subsidiary of

Q65: Poole Co. acquired 100% of Mullen Inc.

Q75: McGraw Corp. owned all of the voting

Q106: On January 1, 2021, Daniel Corp. acquired

Q109: Which of the following statements is true

Q117: Patti Company owns 80% of the common

Q118: Anderson Company, a 90% owned subsidiary of