Multiple Choice

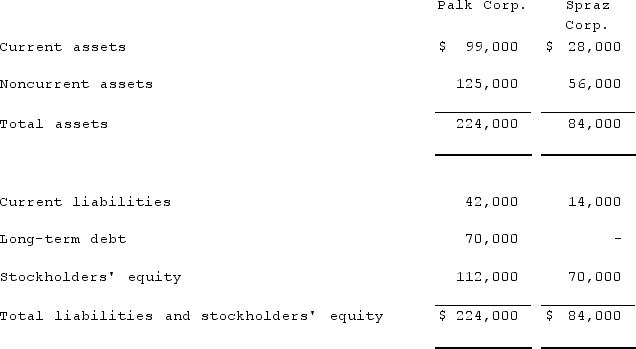

On January 1, 2019, Palk Corp. and Spraz Corp. had condensed balance sheets as follows:  On January 2, 2019, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. Shares of Spraz are not actively traded on the market. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2019. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.What is the amount attributable to consolidated noncurrent assets at January 2, 2019?

On January 2, 2019, Palk borrowed the entire $84,000 it needed to acquire 80% of the outstanding common shares of Spraz. Shares of Spraz are not actively traded on the market. The loan was to be paid in ten equal annual principal payments, plus interest, beginning December 31, 2019. The excess consideration transferred over the underlying book value of the acquired net assets was allocated 60% to inventory and 40% to goodwill.What is the amount attributable to consolidated noncurrent assets at January 2, 2019?

A) $195,000.

B) $192,200.

C) $186,600.

D) $181,000.

E) $169,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q28: Why is it important to know if

Q33: When a parent company acquires a less-than-100

Q45: How would you determine the amount of

Q93: When Valley Co. acquired 80% of the

Q108: Pell Company acquires 80% of Demers Company

Q109: Pell Company acquires 80% of Demers Company

Q111: McGuire Company acquired 90 percent of Hogan

Q113: McGuire Company acquired 90 percent of Hogan

Q115: Pell Company acquires 80% of Demers Company

Q122: On January 1, 2019, Jannison Inc. acquired