Essay

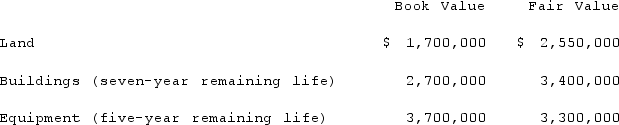

On January 1, 2020, John Doe Enterprises (JDE)acquired a 55% interest in Bubba Manufacturing, Inc. (BMI). JDE paid for the transaction with $3 million cash and 500,000 shares of JDE common stock (par value $1.00 per share). At the time of the acquisition, BMI's book value was $16,970,000.On January 1, JDE stock had a market value of $14.90 per share and there was no control premium in this transaction. Any consideration transferred over book value is assigned to goodwill. BMI had the following balances on January 1, 2020.

For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

For internal reporting purposes, JDE employed the equity method to account for this investment.Prepare a fair-value allocation and amortization schedule, including goodwill allocation.

Correct Answer:

Verified

JDE's fair value of consideration transf...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jax Company used the acquisition method when

Q28: Why is it important to know if

Q33: When a parent company acquires a less-than-100

Q76: Which of the following statements is false

Q92: Renz Co. acquired 80% of the voting

Q101: Pell Company acquires 80% of Demers Company

Q105: On January 1, 2019, Palk Corp. and

Q108: Pell Company acquires 80% of Demers Company

Q109: Pell Company acquires 80% of Demers Company

Q111: McGuire Company acquired 90 percent of Hogan