Multiple Choice

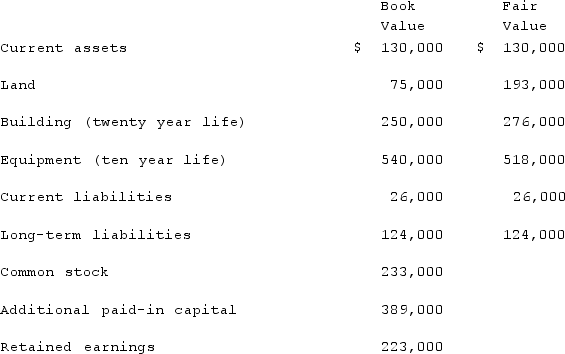

On January 1, 2020, Barber Corp. paid $1,160,000 to acquire Thompson Co. Thompson maintained separate incorporation. Barber used the equity method to account for the investment. The following information is available for Thompson's assets, liabilities, and stockholders' equity accounts on January 1, 2020:  Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?

Thompson earned net income for 2020 of $134,000 and paid dividends of $51,000 during the year.If Barber Corp. had net income of $468,000 in 2020, exclusive of the investment, what is the amount of consolidated net income?

A) $468,000.

B) $519,000.

C) $602,000.

D) $602,900.

E) $691,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Jaynes Inc. acquired all of Aaron Co.'s

Q4: Jackson Company acquires 100% of the stock

Q7: On January 1, 2020, Barber Corp. paid

Q10: Following are selected accounts for Green Corporation

Q11: When a company applies the initial value

Q15: When is a goodwill impairment loss recognized?<br>A)

Q18: Avery Company acquires Billings Company in a

Q59: For recognized intangible assets that are considered

Q110: Anderson, Inc. acquires all of the voting

Q118: With respect to the recognition of goodwill