Multiple Choice

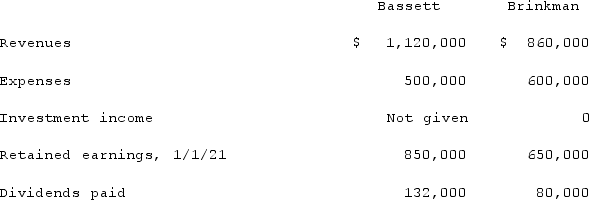

Bassett Inc. acquired all of the outstanding common stock of Brinkman Corp. on January 1, 2019, for $422,000. Equipment with a ten-year life was undervalued on Brinkman's financial records by $48,000. Brinkman also owned an unrecorded customer list with an assessed fair value of $71,000 and an estimated remaining life of five years.Brinkman earned reported net income of $185,000 in 2019 and $226,000 in 2020. Dividends of $75,000 were paid in each of these two years. Selected account balances as of December 31, 2021, for the two companies follow.  If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

If the equity method had been applied, what would be the Investment in Brinkman Corp. account balance within the records of Bassett at the end of 2021?

A) $806,000.

B) $811,000.

C) $863,000.

D) $920,000.

E) $1,036,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: When is a goodwill impairment loss recognized?<br>A)

Q47: Yules Co. acquired Noel Co. and applied

Q73: Which of the following will result in

Q76: Following are selected accounts for Green Corporation

Q77: When a company applies the partial equity

Q80: Pritchett Company recently acquired three businesses, recognizing

Q92: Which of the following is false regarding

Q93: Prince Company acquires Duchess, Inc. on January

Q98: Black Co. acquired 100% of Blue, Inc.

Q99: Kaye Company acquired 100% of Fiore Company