Multiple Choice

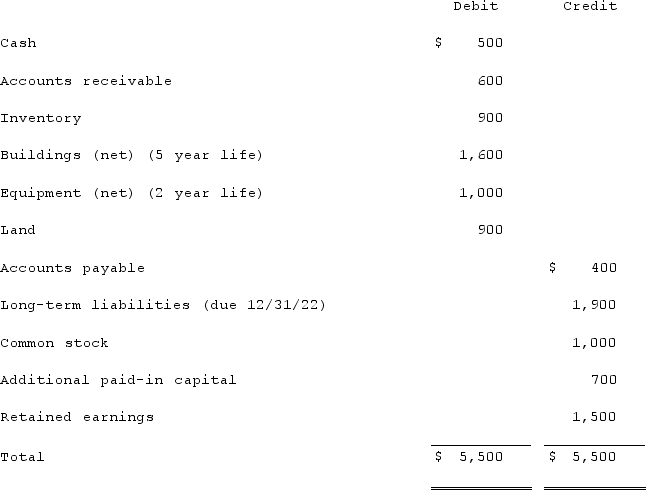

Jackson Company acquires 100% of the stock of Clark Corporation on January 1, 2020, for $4,100 cash. As of that date Clark has the following trial balance:  Net income and dividends reported by Clark for 2020 and 2021 follow:

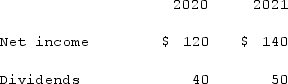

Net income and dividends reported by Clark for 2020 and 2021 follow: The fair value of Clark's net assets that differ from their book values are listed below:

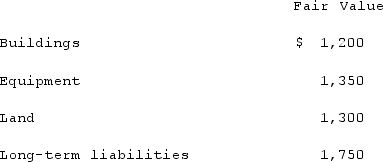

The fair value of Clark's net assets that differ from their book values are listed below: Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

Any excess of consideration transferred over fair value of net assets acquired is considered goodwill with an indefinite life.Compute the amount of Clark's long-term liabilities that would be reported in a December 31, 2020, consolidated balance sheet.

A) $1,700.

B) $1,750.

C) $1,800.

D) $1,850.

E) $1,900.

Correct Answer:

Verified

Correct Answer:

Verified

Q24: How does the partial equity method differ

Q40: Beatty, Inc. acquires 100% of the voting

Q45: What is the basic objective of all

Q53: What should an entity evaluate when making

Q86: Kaye Company acquired 100% of Fiore Company

Q87: Following are selected accounts for Green Corporation

Q89: Jackson Company acquires 100% of the stock

Q91: Watkins, Inc. acquires all of the outstanding

Q93: Following are selected accounts for Green Corporation

Q95: Watkins, Inc. acquires all of the outstanding