Multiple Choice

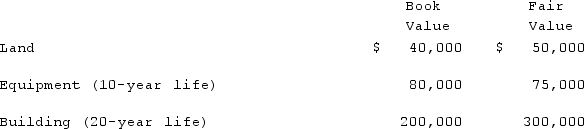

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

If Watkins pays $450,000 in cash for Glen, what acquisition-date fair value allocation, net of amortization, should be attributed to the subsidiary's Equipment in consolidation at December 31, 2022?

A) $(5,000) .

B) $80,000.

C) $75,000.

D) $73,500.

E) $(3,500) .

Correct Answer:

Verified

Correct Answer:

Verified

Q50: Following are selected accounts for Green Corporation

Q52: On January 1, 2019, Rand Corp. issued

Q53: Jaynes Inc. acquired all of Aaron Co.'s

Q56: Following are selected accounts for Green Corporation

Q57: Jackson Company acquires 100% of the stock

Q59: Jackson Company acquires 100% of the stock

Q83: What is the partial equity method? How

Q89: Private companies, with respect to goodwill:<br>A) May

Q102: All of the following are acceptable methods

Q119: Hanson Co. acquired all of the common