Multiple Choice

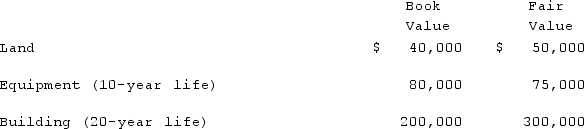

Watkins, Inc. acquires all of the outstanding stock of Glen Corporation on January 1, 2020. At that date, Glen owns only three assets and has no liabilities:  If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2020, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2020?

If Watkins pays $450,000 in cash for Glen, and Glen earns $50,000 in net income and pays $20,000 in dividends during 2020, what amount representing Glen would be reflected in consolidated net income for the year ended December 31, 2020?

A) $20,000 under the initial value method.

B) $30,000 under the partial equity method.

C) $50,000 under the partial equity method.

D) $44,500 under the equity method.

E) $45,500 regardless of the internal accounting method used.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: How is the goodwill impairment process simplified

Q13: Matthews Co. acquired all of the common

Q14: Pritchett Company recently acquired three businesses, recognizing

Q15: Jackson Company acquires 100% of the stock

Q21: Vaughn Inc. acquired all of the outstanding

Q34: One company acquires another company in a

Q35: For an acquisition when the subsidiary retains

Q62: Which of the following internal record-keeping methods

Q76: Under the initial value method, when accounting

Q101: Craft Corp. acquired all of the common