Essay

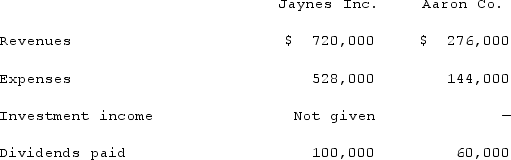

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

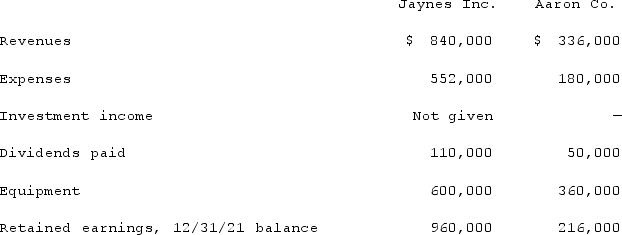

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was the total for consolidated patents as of December 31, 2021?

What was the total for consolidated patents as of December 31, 2021?

Correct Answer:

Verified

Correct Answer:

Verified

Q51: According to GAAP regarding amortization of goodwill,

Q56: Following are selected accounts for Green Corporation

Q57: Jackson Company acquires 100% of the stock

Q59: Jackson Company acquires 100% of the stock

Q74: Harrison, Inc. acquires 100% of the voting

Q84: Under the equity method of accounting for

Q89: Private companies, with respect to goodwill:<br>A) May

Q97: Anderson, Inc. acquires all of the voting

Q112: Vaughn Inc. acquired all of the outstanding

Q122: Scott Co. paid $2,800,000 to acquire all