Essay

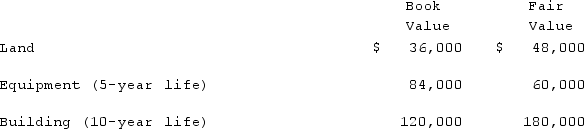

Utah Inc. acquired all of the outstanding common stock of Trimmer Corp. on January 1, 2019. At that date, Trimmer owned only three assets and had no liabilities:

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

If Utah paid $300,000 in cash for Trimmer, what allocation and amortization should have been assigned to the subsidiary's Building account and its Equipment account in a December 31, 2021 consolidation?

Correct Answer:

Verified

Since Utah paid more than the ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Fesler Inc. acquired all of the outstanding

Q26: How is the fair value allocation of

Q39: Jackson Company acquires 100% of the stock

Q45: Bassett Inc. acquired all of the outstanding

Q48: When a company applies the initial value

Q54: On January 1, 2020, Hemingway Co. acquired

Q67: When consolidating parent and subsidiary financial statements,

Q86: Reeder Corp. acquired one hundred percent of

Q100: Beatty, Inc. acquires 100% of the voting

Q102: All of the following are acceptable methods