Multiple Choice

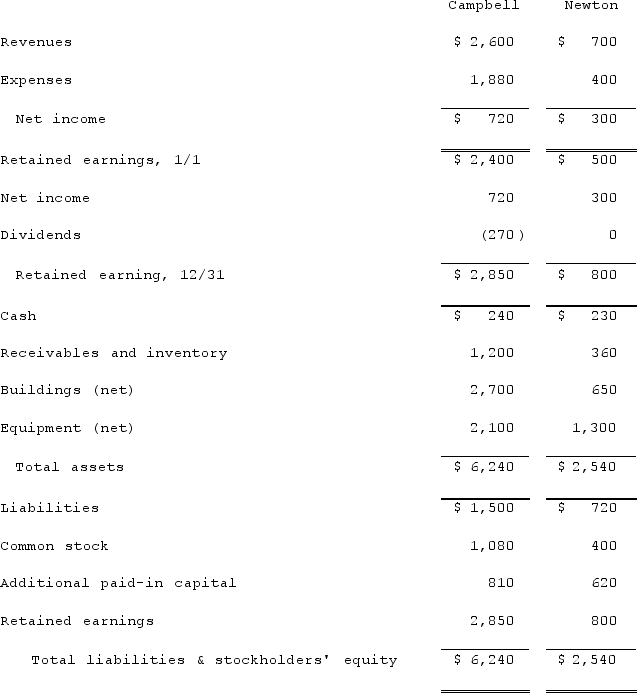

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated expenses for 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated expenses for 2021.

A) $1,880.

B) $1,905.

C) $2,280.

D) $2,305.

E) $2,335.

Correct Answer:

Verified

Correct Answer:

Verified

Q40: Presented below are the financial balances for

Q41: Presented below are the financial balances for

Q42: Jernigan Corp. had the following account balances

Q43: Flynn acquires 100 percent of the outstanding

Q45: Presented below are the financial balances for

Q47: On January 1, 2021, the Moody Company

Q48: The financial statement amounts for the Atwood

Q50: What is the primary difference between: (i)

Q108: Acquired in-process research and development is considered

Q116: Fine Co. issued its common stock in