Multiple Choice

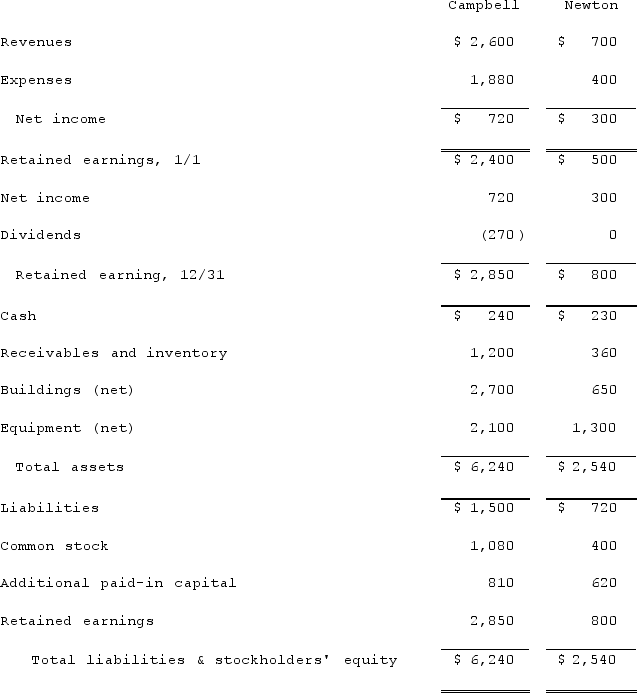

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated equipment (net) account at December 31, 2021.

A) $1,300.

B) $1,450.

C) $2,100.

D) $3,400.

E) $3,550.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: A statutory merger is a(n)<br>A) Business combination

Q39: Which of the following statements is true

Q100: The following are preliminary financial statements for

Q101: McCoy has the following account balances as

Q103: The financial statements for Campbell, Inc., and

Q104: The financial statements for Campbell, Inc., and

Q106: Elon Corp. obtained all of the common

Q107: The financial statement amounts for the Atwood

Q109: In an acquisition where 100% control is

Q110: Flynn acquires 100 percent of the outstanding