Essay

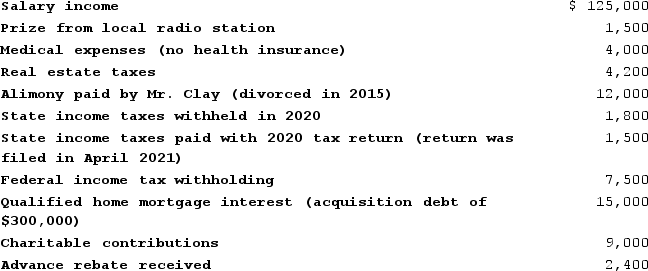

During all of 2020, Mr. and Mrs. Clay lived with their four children (all are under the age of 17). They provided over one-half of the support for each child. Mr. and Mrs. Clay file jointly for 2020. Neither is blind, and both are under age 65. They reported the following tax-related information for the year. (Use the tax rate schedules, 2020 Alternative minimum tax (AMT)exemption)

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)What are the Clays' tentative minimum tax and alternative minimum tax?

Correct Answer:

Verified

A. Tax refund is $5,330.

Answer computed...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Answer computed...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q124: During 2020, Montoya (age 15)received $2,200 from

Q125: The Olympians have three children. The kiddie

Q126: Carolyn has an AGI of $39,900 (all

Q127: In 2020, Shawn's adjusted gross income (AGI)is

Q128: Which of the following statements regarding the

Q130: Which of the following tax credits is

Q131: Assume Georgianne underpaid her estimated tax liability

Q132: Jackson earned a salary of $254,000 in

Q133: Julien and Sarah are married, file a

Q134: Which of the following statements regarding late