Essay

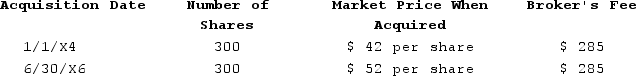

On December 1, 20X7, George Jimenez needed a little extra cash for the upcoming holiday season, and sold 250 shares of Microsoft stock for $57 per share less a broker's fee of $200 for the entire sale transaction. Prior to the sale, George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase). (Round your intermediate calculations to 2 decimal places)

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain, how much capital gain will George report from the sale?

Correct Answer:

Verified

Using the specific identification method...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: On January 1, 20X1, Fred purchased a

Q27: A loss from a passive activity is

Q28: When selling stocks, which method of calculating

Q29: When electing to include preferentially taxed capital

Q30: The amount of interest income a taxpayer

Q32: On January 1, 20X8, Jill contributed $18,000

Q33: Henry, a single taxpayer with a marginal

Q34: Taxpayers may make an election to include

Q35: Two advantages of investing in capital assets

Q36: Doug and Sue Click file a joint