Essay

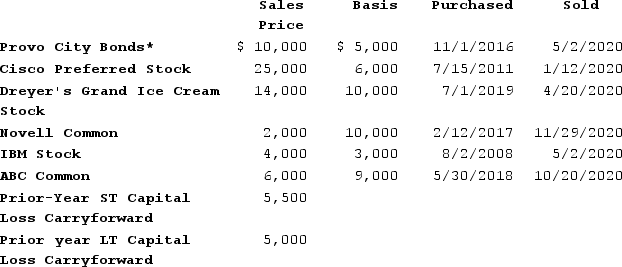

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2020 Schedule D? What is the net long-term capital gain/loss reported on the 2020 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Correct Answer:

Verified

$1,500 net short-term capital loss is re...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q48: Mr. and Mrs. Smith purchased 100 shares

Q49: Which of the following is not a

Q50: In X8, Erin had the following capital

Q51: Judy, a single individual, reports the following

Q52: The investment interest expense deduction is limited

Q54: On January 1, 20X8, Jill contributed $25,000

Q55: Long-term capital gains (depending on type)for individual

Q56: The Crane family recognized the following types

Q57: Dave and Jane file a joint return.

Q58: Ms. Fresh bought 1,000 shares of Ibis