Essay

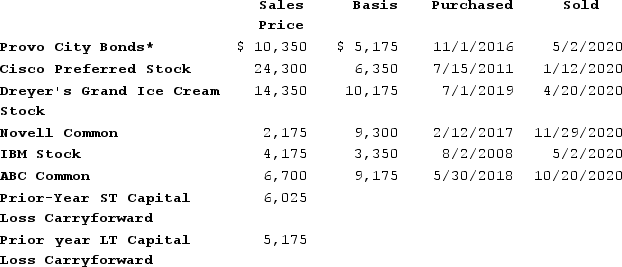

Scott Bean is a computer programmer and incurred the following transactions last year.

*Purchased when originally issued by Provo City.

*Purchased when originally issued by Provo City.

What is the net short-term capital gain/loss reported on the 2020 Schedule D? What is the net long-term capital gain/loss reported on the 2020 Schedule D? What amount of capital gain is subject to the preferential capital gains rate?

Correct Answer:

Verified

${{[a(16)]:#,###}} net short-term capita...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q8: Cory recently sold his qualified small business

Q9: Qualified dividends are always taxed at a

Q10: Alain Mire files a single tax return

Q11: Which taxpayer would not be considered a

Q12: Michelle is an active participant in the

Q14: Sue invested $5,000 in the ABC Limited

Q15: What requirements must be satisfied before an

Q16: In X8, Erin had the following capital

Q17: Capital loss carryovers for individuals are carried

Q18: John holds a taxable bond and a