Essay

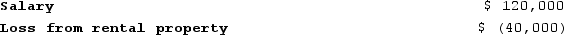

Judy, a single individual, reports the following items of income and loss:

Judy owns 100percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Judy owns 100percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Correct Answer:

Verified

$105,000

S...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

S...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q40: Describe the three main loss limitations that

Q41: The capital gains (losses)netting process for taxpayers

Q42: Ms. Fresh bought 1,000 shares of Ibis

Q43: In the current year, Norris, an individual,

Q44: Michelle is an active participant in the

Q46: On December 1, 20X7, George Jimenez needed

Q47: When the wash sale rules apply, the

Q48: Mr. and Mrs. Smith purchased 100 shares

Q49: Which of the following is not a

Q50: In X8, Erin had the following capital