Essay

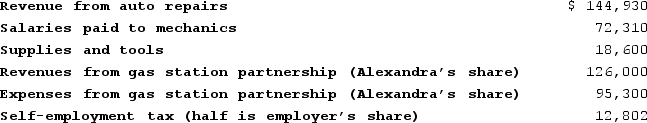

Alexandra operates a garage as a sole proprietorship. Alexandra also owns a half interest in a partnership that operates a gas station. This year Alexandra paid or reported the following expenses related to her garage and other property. Determine Alexandra's AGI for 2020.

Correct Answer:

Verified

${{[a(10)]:#,###}}.

All of the...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All of the...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q63: Misti purchased a residence this year. Misti,

Q64: In 2020, the deduction to individual taxpayers

Q65: Bunching itemized deductions is one form of

Q66: Campbell, a single taxpayer, has $400,000 of

Q67: Excess business losses are carried back and

Q69: This year Tiffanie files as a single

Q70: Frieda is 67 years old and deaf.

Q71: Max, a single taxpayer, has a $270,000

Q72: Carly donated inventory (ordinary income property)to a

Q73: This year, Benjamin Hassell paid $17,250 of