Essay

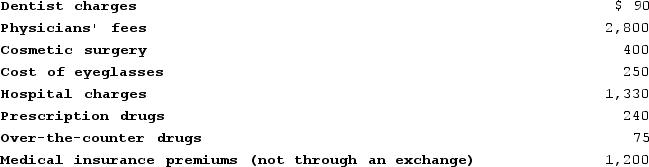

Jenna (age 50)files single and reports AGI of $40,000. This year she has incurred the following medical expenses:

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Calculate the amount of medical expenses that will be included with Jenna's other itemized deductions.

Correct Answer:

Verified

$1,910.

All expenses are qualified medic...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

All expenses are qualified medic...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q83: Claire donated 200 publicly traded shares of

Q84: Unreimbursed employee business expenses and hobby expenses

Q85: Margaret Lindley paid $15,000 of interest on

Q86: All reasonable moving expenses are deductible by

Q87: Which of the following taxes will not

Q89: For married taxpayers filing separately, excess business

Q90: Campbell, a single taxpayer, has $400,000 of

Q91: Bruce is employed as an executive and

Q92: Opal fell on the ice and injured

Q93: Deductible medical expenses include payments to medical