Multiple Choice

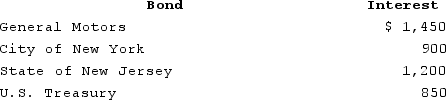

Mike received the following interest payments this year. What amount must Mike include in his gross income (for federal tax purposes) ?

A) $1,450

B) $2,300

C) $2,650

D) $3,550

E) $4,400

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q58: The exclusion ratio for a purchased annuity

Q59: Sam, age 45, saved diligently for his

Q60: The tax law defines alimony to include

Q61: To provide relief from double taxation, Congress

Q62: Pam recently was sickened by eating spoiled

Q64: Identify the rule dictating that on sale

Q65: Aubrey and Justin file married filing separately.

Q66: Janine's employer loaned her $5,000 this year

Q67: Samantha was ill for four months this

Q68: Ophra is a cash-basis taxpayer who is