Essay

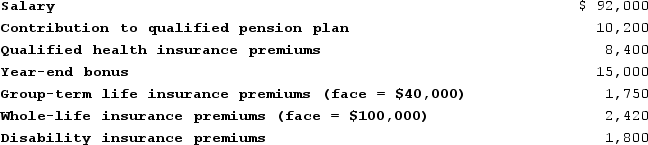

Andres has received the following benefits this year.

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Besides these benefits Andres missed work for two months due to an illness. During his illness Andres received $6,500 in sick pay from a disability insurance policy. Assume Andres has disability insurance provided by his employer as a nontaxable fringe benefit. What amount, if any, must Andres include in gross income this year?

Correct Answer:

Verified

$115,920 = $92,000 + $15,000 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q80: Acme published a story about Paul, and

Q81: Barter clubs are an effective means of

Q82: This year Barney purchased 500 shares of

Q83: In April of this year Victoria received

Q84: Teresa was married on November 1 of

Q86: Ben received the following benefits from his

Q87: Vincent is a writer and a U.S.

Q88: Identify the item below that helps determine

Q89: When a carpenter provides $100 of services

Q90: This year Barney purchased 300 shares of