Essay

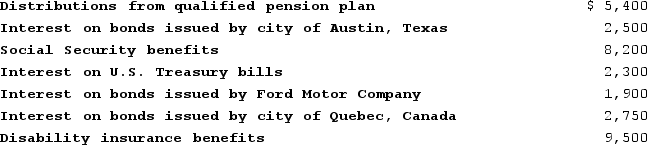

Caroline is retired and receives income from a number of sources. The interest payments are from bonds that Caroline purchased over past years and a disability insurance policy that Caroline purchased. Calculate Caroline's gross income.

Correct Answer:

Verified

$12,350 = $5,400 + $2,300 + $1,900 + $2,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q89: When a carpenter provides $100 of services

Q90: This year Barney purchased 300 shares of

Q91: Shaun is a student who has received

Q92: Charles and Camillagot divorced in 2018. Under

Q93: Blake is a limited partner in Kling-On

Q95: Jake sold his car for $2,400 in

Q96: Rental income generated by a partnership is

Q97: Barney and Betty got divorced in 2018.

Q98: This year Kevin provided services to several

Q99: Constructive receipt represents the principle that cash-basis