Multiple Choice

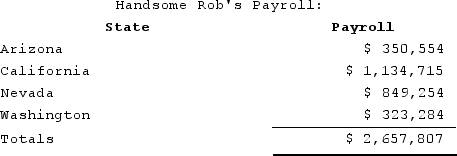

Handsome Rob provides transportation services in several western states. Rob has payroll as follows:  Rob is a California corporation and the following is true:

Rob is a California corporation and the following is true:

Rob hasincome tax nexus in Arizona, California, Nevada, and Washington. The Washington drivers spend 25 percent of their time driving through Oregon. California payroll includes $201,400 of payroll for services provided in Nevada by California-based drivers. What is Rob's California payroll numerator?

A) $933,315.

B) $1,134,715.

C) $1,215,389.

D) $2,657,807.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Gordon operates the Tennis Pro Shop in

Q13: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q14: Most state tax laws adopt the federal

Q15: Gordon operates the Tennis Pro Shop in

Q16: Which of the following law types is

Q18: Public Law 86-272 protects solicitation from income

Q19: Federal/state adjustments correct for differences between two

Q20: Gordon operates the Tennis Pro Shop in

Q21: Which of the following regarding the state

Q22: The Mobil decision identified three factors to