Essay

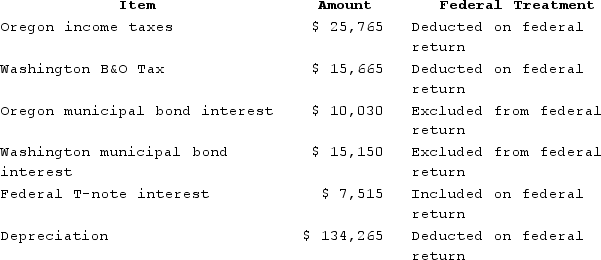

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,515. Moss's federal taxable income was $549,773. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,515. Moss's federal taxable income was $549,773. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Correct Answer:

Verified

${{[a(9)]:#,###}}.

${{[a(8)]:#...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

${{[a(8)]:#...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: The property factor is generally calculated as

Q43: Mighty Manny, Incorporated manufactures ice scrapers and

Q44: Wacky Wendy produces gourmet cheese in Wisconsin.

Q45: Gordon operates the Tennis Pro Shop in

Q46: Mahre, Incorporated, a New York corporation, runs

Q48: Sales personnel investigating a potential customer's creditworthiness

Q49: Tennis Pro has the following sales, payroll,

Q50: Several states are now moving from a

Q51: Gordon operates the Tennis Pro Shop in

Q52: Immaterial violations of the solicitation rules automatically