Essay

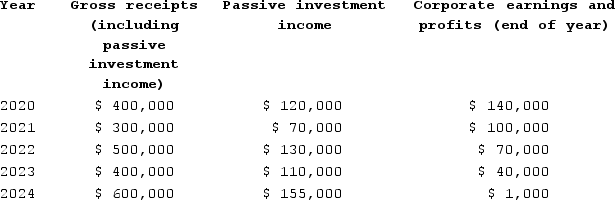

Neal Corporation was initially formed as a C corporation with a calendar year-end. Neal elected S corporation status, effective January 1, 2020. On December 31, 2019, Neal Corporation reported earnings and profits of $150,000. Beginning in 2020, Neal Corporation reported the following information. Does Neal Corporation's S election terminate due to excess net passive income? If so, what is the effective date of the termination?

Correct Answer:

Verified

The S election is terminated at the end ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q5: Which of the following is the correct

Q6: Suppose Clampett, Incorporated, terminated its S election

Q7: CB Corporation was formed as a calendar-year

Q8: Clampett, Incorporated, has been an S corporation

Q9: Suppose that at the beginning of 2020

Q11: Assume Joe Harry sells his 25percent interest

Q12: If an S corporation never operated as

Q13: ABC Corporation elected to be taxed as

Q14: Vanessa contributed $20,000 of cash and land

Q15: Tone Loc and 89 of his biggest