Essay

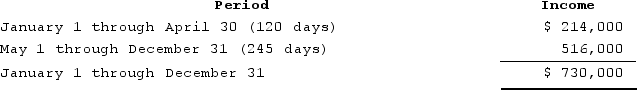

ABC was formed as a calendar-year S corporation with Alan, Brenda, and Conner as equal shareholders. On May 1, 2020, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares)to his solely owned C corporation, Conner, Incorporated ABC reported business income for 2020 as follows: (Assume that there are 365 days in the year.)

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Correct Answer:

Verified

S corporation short ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q74: Unlikein partnerships, adjustments that decrease an S

Q75: CB Corporation was formed as a calendar-year

Q76: Parker is a 100percent shareholder of Johnson

Q77: Maria resides in San Antonio, Texas. She

Q78: Lamont is a 100percent owner of JKL

Q80: Built-in gains recognized 15 years after a

Q81: An S corporation shareholder's allocable share of

Q82: Distributions to owners may not cause the

Q83: Bobby T (95percent owner)would like to elect

Q84: If Annie and Andy (each a 30percent