Essay

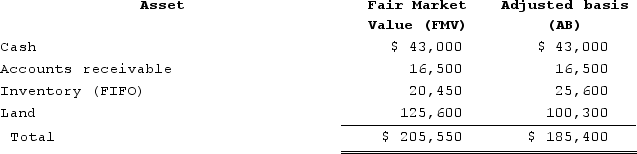

MWC is a C corporation that uses the accrual method of accounting. MWC made an S election, effective January 1 of 2020. The following assets were owned by MWC on December 31, 2019.

What is MWC's net unrealized built-in gain when it converts to an S corporation on January 1, 2020?

What is MWC's net unrealized built-in gain when it converts to an S corporation on January 1, 2020?

Correct Answer:

Verified

${{[a(12)]:#,###}}. The (${{[a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q20: An S corporation shareholder's allocable share of

Q21: During 2020, CDE Corporation (an S corporation

Q22: Hazel is the sole shareholder of Maple

Q23: C corporations that elect S corporation status

Q24: S corporations may have no more than

Q26: S corporations without earnings and profits from

Q27: Clampett, Incorporated, has been an S corporation

Q28: Assume that Clampett, Incorporated, has $200,000 of

Q29: Which of the following is not a

Q30: Which of the following statements is correct?<br>A)The