Essay

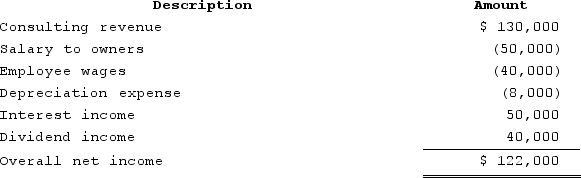

RGD Corporation was a C corporation from its inception in 2016 through 2019. However, it elected S corporation status effective January 1, 2020. RGD had $50,000 of earnings and profits at the end of 2019. RGD reported the following information for its 2020 tax year.

What amount of excess net passive income tax is RGD liable for in 2020? (Round your answer for excess net passive income to the nearest thousand.)

What amount of excess net passive income tax is RGD liable for in 2020? (Round your answer for excess net passive income to the nearest thousand.)

Correct Answer:

Verified

$7,350 (21% × $35,000). Passive investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q98: Jason is one of 100 shareholders in

Q99: Assume Joe Harry sells his 25percent interest

Q100: XYZ was formed as a calendar-year S

Q101: Clampett, Incorporated, has been an S corporation

Q102: S corporations have considerable flexibility in making

Q104: Shea, an individual, is a 100percent owner

Q105: An S corporation election may be voluntarily

Q106: Similar to an S corporation shareholder's stock

Q107: Which of the following statements is correct

Q108: To make an S election effective as