Essay

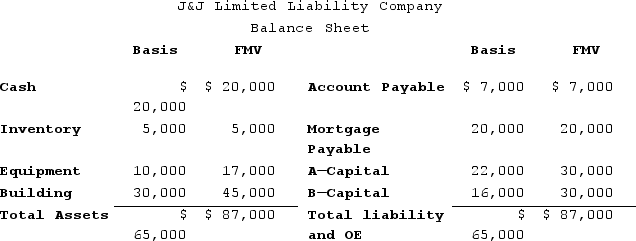

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

If member C received a one-third capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q57: Actual or deemed cash distributions in excess

Q58: On 12/31/X4, Zoom, LLC, reported a $60,000

Q59: KBL, Incorporated, AGW, Incorporated, Blaster, Incorporated, Shiny

Q60: Nonrecourse debt is generally allocated according to

Q61: XYZ, LLC, has several individual and corporate

Q63: Which of the following statements regarding partnership

Q64: Zinc, LP was formed on August 1,

Q65: This year, HPLC, LLC, was formed by

Q66: Tim, a real estate investor, Ken, a

Q67: A partner can generally apply passive activity