Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, Formed

Essay

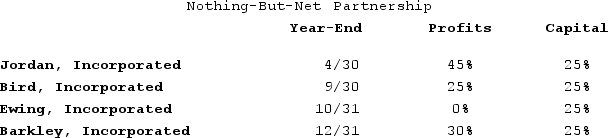

Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and Barkley, Incorporated, formed Nothing-But-Net Partnership on June 1st, 20X9. Now, Nothing-But-Net must adopt its required tax year-end. The partners' year-ends, profits interests, and capital interests are reflected in the table below. Given this information, what tax year-end must Nothing-But-Net use, and what rule requires this year-end?

Correct Answer:

Verified

Because the partners all have different ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q30: On January 1, X9, Gerald received his

Q31: Partnerships may maintain their capital accounts according

Q32: Which requirement must be satisfied in order

Q33: When must a partnership file its return?<br>A)By

Q34: This year, Reggie's distributive share from Almonte

Q36: Under proposed regulations issued by the Treasury

Q37: Partnerships can request up to a six-month

Q38: Sarah, Sue, and AS Incorporated formed a

Q39: Erica and Brett decide to form their

Q40: Partnership tax rules incorporate both the entity