Essay

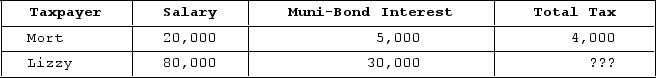

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Correct Answer:

Verified

Mort's average tax rate is 20 percent.Av...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q44: The 9 <sup>th</sup> Amendment to the U.S.

Q45: Which of the following is not an

Q46: Which of the following taxes represents the

Q47: Ricky and Lucy are debating several types

Q48: Marc, a single taxpayer, earns $60,000 in

Q50: Junior earns $80,000 taxable income as a

Q51: A common example of an employment-related tax

Q52: Which of the following statements is true?<br>A)Municipal

Q53: Leonardo, who is married but files separately,

Q54: The largest federal tax, in terms of