Essay

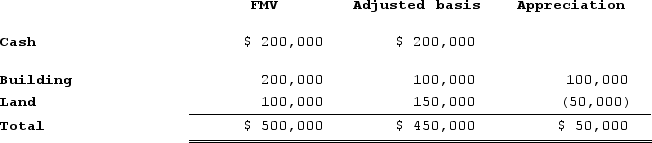

Mike and Michelle decided to liquidate their jointly owned corporation, Pennsylvania Corporation. After liquidating its remaining inventory and paying off its remaining liabilities, Pennsylvania had the following tax accounting balance sheet.

Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is $100,000.

Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is $100,000.

What amount of gain or loss does Pennsylvania recognize in the complete liquidation?

Correct Answer:

Verified

Pennsylvania has a taxable transaction a...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q28: Mike and Michelle decided to liquidate their

Q29: Maria defers $100 of gain realized in

Q30: Tristan transfers property with a tax basis

Q31: Which of the following statements best describes

Q32: A liquidated corporation will always recognize gain

Q34: The City of Boston made a capital

Q35: Robin transferred her 60 percent interest to

Q36: Packard Corporation transferred its 100 percent interest

Q37: Juan transferred 100 percent of his stock

Q38: Which of the following statements best describes