Essay

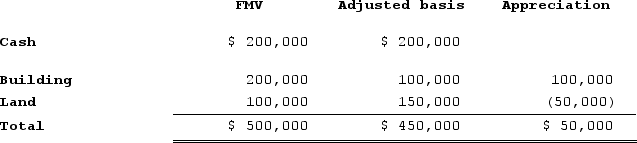

Mike and Michelle decided to liquidate their jointly owned corporation, Pennsylvania Corporation. After liquidating its remaining inventory and paying off its remaining liabilities, Pennsylvania had the following tax accounting balance sheet.

Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is $100,000.

Under the terms of the agreement, Mike will receive the $200,000 cash in exchange for his 40 percent interest in Pennsylvania. Mike's tax basis in his Pennsylvania stock is $50,000. Michelle will receive the building and land in exchange for her 60 percent interest in Pennsylvania. Her tax basis in the Pennsylvania stock is $100,000.

What amount of gain or loss does Michelle recognize in the complete liquidation, and what is her tax basis in the building and land after the complete liquidation?

Correct Answer:

Verified

Michelle recognizes gain of $200,000 on ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q42: Ken and Jim agree to go into

Q43: Generally, before gain or loss is realized

Q44: Jalen transferred his 10 percent interest to

Q45: Jasmine transferred 100 percent of her stock

Q46: Amy transfers property with a tax basis

Q48: Which of the following statements best describes

Q49: Roberta transfers property with a tax basis

Q50: Ken and Jim agree to go into

Q51: Celeste transferred 100 percent of her stock

Q52: Harry and Sally formed Empire Corporation on