Essay

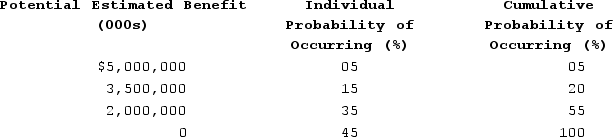

Acai Corporation determined that $5,000,000 of its R&D credit on its current-year tax return was uncertain. Acai determined that there was a 40 percent chance of the credit being sustained on audit. Management made the following assessment of the company's potential tax benefit from the R&D credit and its probability of occurring.

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Under ASC 740, what amount of the tax benefit related to the R&D credit can Acai recognize in calculating its income tax provision in the current year?

Correct Answer:

Verified

$0.Acai cannot record any tax ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q59: Temporary differences that are cumulatively "favorable" are

Q60: Morgan Corporation determined that $1,100,000 of the

Q61: Irish Corporation reported pretax book income of

Q62: MAC, Incorporated, completed its first year of

Q63: Which of the following statements is true?<br>A)A

Q65: Which of the following statements is true?<br>A)Another

Q66: ASC 740 permits a corporation to net

Q67: Which of the following temporary differences creates

Q68: ASC 740 requires a publicly traded company

Q69: Jones Company reported pretax book income of