Essay

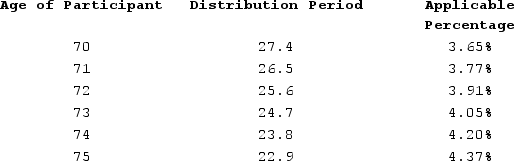

Sean (age 72 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,760,000 and the balance in his account on December 31, 2020, was $1,825,000. In 2020, Sean received a distribution of $65,000 from his 401(k)account(not a coronavirus-related distribution). Assuming Sean's marginal tax rate is 25 percent, what amount of the $65,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining the required minimum distribution penalty, if any).

Correct Answer:

Verified

${{[a(11)]:#,###}} remaining after taxes...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q36: Just like distributions from qualified retirement plans,

Q37: Joan recently started her career with PDEK

Q38: Kathy is 60 years of age and

Q39: Retired taxpayers over 59½ years of age

Q40: Aiko (single, age 29)earned $40,000 in 2020.

Q42: Sean (age 72 at end of 2020)retired

Q43: Which of the following statements regarding contributions

Q44: Kathy is 60 years of age and

Q45: Lisa, age 47, needed some cash so

Q46: Which of the following statements regarding traditional