Multiple Choice

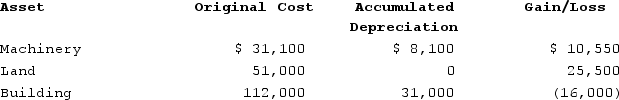

Brandon, an individual, began business four years ago and has sold §1231 assets with $5,550 of losses within the last five years. Brandon owned each of the assets for several years. In the current year, Brandon sold the following business assets:  Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability? Use dividends and capital gains tax rates for reference.

Assuming Brandon's marginal ordinary income tax rate is 32 percent, what effect do the gains and losses have on Brandon's tax liability? Use dividends and capital gains tax rates for reference.

A) $20,050 ordinary income and $6,416 tax liability.

B) $20,050 §1231 gain and $3,008 tax liability.

C) $6,400 §1231 gain, $13,650 ordinary income, and $5,328 tax liability.

D) $13,650 §1231 gain, $6,400 ordinary income, and $4,096 tax liability.

E) None of the choices are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Boot is not like-kind property involved in

Q12: Manassas purchased a computer several years ago

Q13: Bateman Corporation sold an office building that

Q14: Losses on sales between related parties are

Q15: Depreciation recapture changes both the amount and

Q17: Accounts receivable and inventory are examples of

Q18: Andrew, an individual, began business four years

Q19: Ashburn reported a $105,000 net §1231 gain

Q20: Which of the following is how gain

Q21: Ashburn reported a $104,875 net §1231 gain