Essay

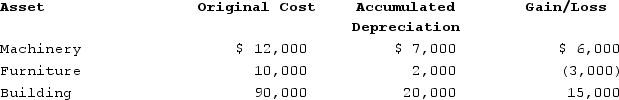

Suzanne, an individual, began business four years ago and has never sold a §1231 asset. Suzanne owned each of the assets for several years. In the current year, Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent, what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Correct Answer:

Verified

$6,000 ordinary gain, $12,000 unrecaptur...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q116: §1231 assets include all assets used in

Q117: Which of the following results in an

Q118: Which of the following transactions results solely

Q119: Residential real property is not like-kind with

Q120: The adjusted basis is the initial basis

Q122: Assets held for investment and personal use

Q123: The §1231 look-back rule recharacterizes §1231 gains

Q124: Realized gains are recognized unless there is

Q125: Brad sold a rental house that he

Q126: Maryexchanged an office building used in her