Multiple Choice

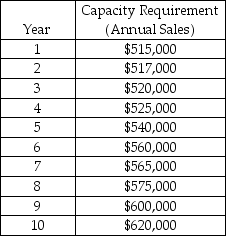

Sleep Tight Motel has the opportunity to purchase an adjacent plot of land. Building on this land would increase their capacity from the current sales level of $515,000/year to $600,000/year. Sleep Tight experiences a 20 percent before-tax profit margin. It wishes to estimate the additional before-tax profits that the expansion will produce. Using the following information, how much more before-tax cash flow would be realized just in year 10 alone?

A) less than or equal to $20,000

B) greater than $20,000 but less than or equal to $25,000

C) greater than $25,000 but less than or equal to $30,000

D) greater than $30,000

Correct Answer:

Verified

Correct Answer:

Verified

Q60: Although the fire marshal had declared the

Q61: Scenario 4.5<br>The T. H. King Company has

Q62: _ are more appropriate measures of capacity

Q63: A smaller capacity cushion may be preferred

Q64: Scenario 4.6<br>Burdell Labs is a diagnostic laboratory

Q66: Define utilization and give a service process

Q67: Long-term capacity plans deal with:<br>A) investments in

Q68: Kristen made a batch of chocolate chip

Q69: _ are useful capacity analysis tools when

Q70: As the desired capacity cushion increases, the