Multiple Choice

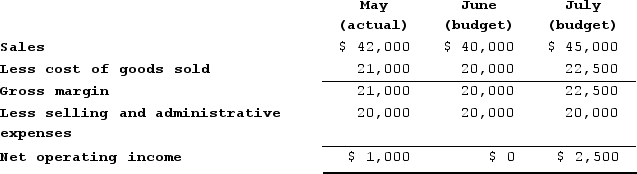

KAB Incorporated, a small retail store, had the following results for May. The budgets for June and July are also given.  Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The amount of cash collected during June should be:

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The amount of cash collected during June should be:

A) $32,000

B) $40,000

C) $40,400

D) $41,000

Correct Answer:

Verified

Correct Answer:

Verified

Q71: All of Pocast Corporation's sales are on

Q72: Hesterman Corporation makes one product and has

Q73: When preparing a direct materials budget, the

Q74: Bramble Corporation is a small wholesaler of

Q75: In the manufacturing overhead budget, the non-cash

Q77: Hesterman Corporation makes one product and has

Q78: Sthilaire Corporation is working on its direct

Q79: Bramble Corporation is a small wholesaler of

Q80: Fiwrt Corporation manufactures and sells stainless steel

Q81: Luchini Corporation makes one product and it