Multiple Choice

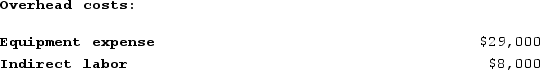

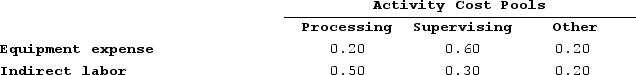

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

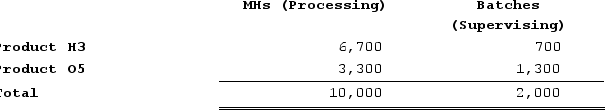

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

A) $5,800

B) $9,800

C) $4,000

D) $7,400

Correct Answer:

Verified

Correct Answer:

Verified

Q159: Paparo Corporation has provided the following data

Q160: Riedell Corporation is conducting a time-driven activity-based

Q161: Activity-based costing is a costing method that

Q162: Direct materials costs are usually excluded from

Q163: Annika Company uses activity-based costing. The company

Q165: Groleau Corporation has an activity-based costing system

Q166: Daston Company manufactures two products, Product F

Q167: The following data have been provided by

Q168: Grassie Corporation is conducting a time-driven activity-based

Q169: Beckley Corporation has provided the following data