Multiple Choice

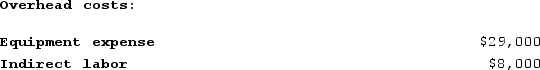

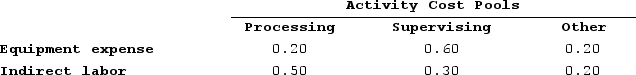

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

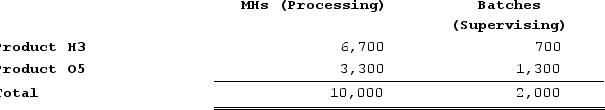

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

A) $6,930

B) $13,496

C) $18,500

D) $6,566

Correct Answer:

Verified

Correct Answer:

Verified

Q236: Jahnel Corporation is conducting a time-driven activity-based

Q237: Perl Corporation uses an activity-based costing system

Q238: Roediger Corporation is conducting a time-driven activity-based

Q239: Gutknecht Corporation uses an activity-based costing system

Q240: In activity-based costing, a product margin may

Q242: Wedd Corporation uses activity-based costing to assign

Q243: Pacius Corporation is conducting a time-driven activity-based

Q244: When activity-based costing is used for internal

Q245: Weimar Corporation is conducting a time-driven activity-based

Q246: Gould Corporation uses the following activity rates